An eCommerce merchant account is an account that allows businesses to accept payments online. If you're starting an eCommerce business, this is a necessity.

However, not all merchant accounts are created equal. Different eCommerce accounting companies offer different services like ERP examples, and some are better for one industry than others.

Read on to learn about various eCommerce merchant account services, the best providers for your needs, options for high risk businesses, and low-cost options for smaller businesses.

eCommerce Merchant Account Services

The single service that every merchant account company provides is processing online payments. This may include ACH payment, eCheck, recurring payments, credit cards, and more. Not all merchant accounts can handle the same type of transaction, so it's important to do your research. In addition, there are a few other services you may need.

These are the most common eCommerce merchant account services:

- PCI compliance. PCI stands for payment card industry and it is used to control and regulate the security of credit card transactions. The PCI Security Standards Council monitors credit card payments and routinely publishes new requirements for security. Failing to meet PCI DSS requirements can give hackers access to sensitive information and open your business up to lawsuits.

- Integrated shopping cart. Not every merchant account has this functionality and may require customers to go off-site to complete a transaction. This is terrible for your cart abandonment rate as it makes many customers uncomfortable so they don't complete their order. Picking a merchant with this functionality should be a priority and help keep you from having to send that abandoned cart email so often.

- Fraud monitoring. Beyond just being PCI complaint, many merchant accounts also have customizable fraud monitoring services. From detecting high-risk accounts to preventing robot transactions to flagging stolen credit cards, fraud monitoring is a great thing to have. This will protect your bank account and let you continue to handle eCommerce payment processing without worry.

Best eCommerce Merchant Account Provider

Ultimately, the best eCommerce merchant account provider will depend on your needs and preferences. That being said, there are several companies that stand out among the sea of providers.

Here are some of the best eCommerce merchant account providers:

- Stripe. Also one of our picks for the best payment gateway, Stripe is a truly comprehensive provider. It has a best-in-class security certification and can handle nearly any payment type you'll come across. We like it so much, it's integrated into our own BlueCart eCommerce platform. If you choose to use BlueCart eCommerce, you’ll get all of the features Stripe provides, including a secure payment gateway, industry-lowest fees, and much more.

- Square. Another big name in the business, Square is a great choice for small businesses both online and offline. It's easy to integrate with an existing POS system and accepts most payment methods. If you're in the middle of an O2O transition, or just have a physical storefront, this is a good choice for your business.

- Authorize.net. A lesser-known name in the industry, Authorize.net makes our list due to its strong focus on transaction security. Advanced fraud detection and the highest PCI compliance make this a good choice for any business with large transactions or a high average order value. It's also a good choice for international businesses. Money made when you sell online is not automatically deposited into your bank account if it's from overseas, so a merchant account can help give you access to the funds more quickly.

- Ayden. The best part of Ayden's platform is its simplicity. It accepts online and offline payments, can quickly be linked to a POS system, and more. But, the real benefit is that the customer support is top-tier, so you're never left guessing. If you want a more hands-off solution or use an online marketplace to sell, Ayden may be the choice for you.

- Cybersource. Our final choice, Cybersource, it's a good choice for eCommerce businesses targeting international sales. Many dropshipping and other eCommerce businesses get a majority of their sales through international channels. This comes with a unique set of challenges, so using a trusted merchant account can really make a difference. It's also highly flexible and can be linked to multiple payment processors if needed.

Best Merchant Account For High Risk eCommerce

If you're in the market for a high risk ecommerce merchant account, your best bet is PaymentCloud. They specialize in high-risk businesses and rely on a network of third-party payment processors to help your business succeed. Unfortunately, you won't have access to some of the best banks if you are in a high-risk industry.

Cannabis sales, pharmaceuticals, gambling, and more types of high-risk businesses will often not be able to find a merchant account provider. This is because the bigger names in the industry view those businesses as more likely to be at risk for fraud and chargebacks. Luckily, providers like PaymentCloud are helping fill the gap and helping business owners.

Credit Card Processing eCommerce Merchant Account

Not all eCommerce merchant account providers also provide credit card payment processing. If they did, payment gateway and processing companies wouldn't exist. Stripe and Square are the two best options that cover all aspects of payment processing and merchant accounts. If you want to limit the amount of eCommerce software you invest in, these two options are your best bet. You can safely and securely process payments, access money, issue refunds, and more.

Cheap eCommerce Merchant Account

Most startup eCommerce businesses can't afford the most high-end payment processing services. Still, it's worth investing in a well-known merchant account to avoid issues in the long run. Find the ones that offer the most important services for your business.

Here are a few considerations:

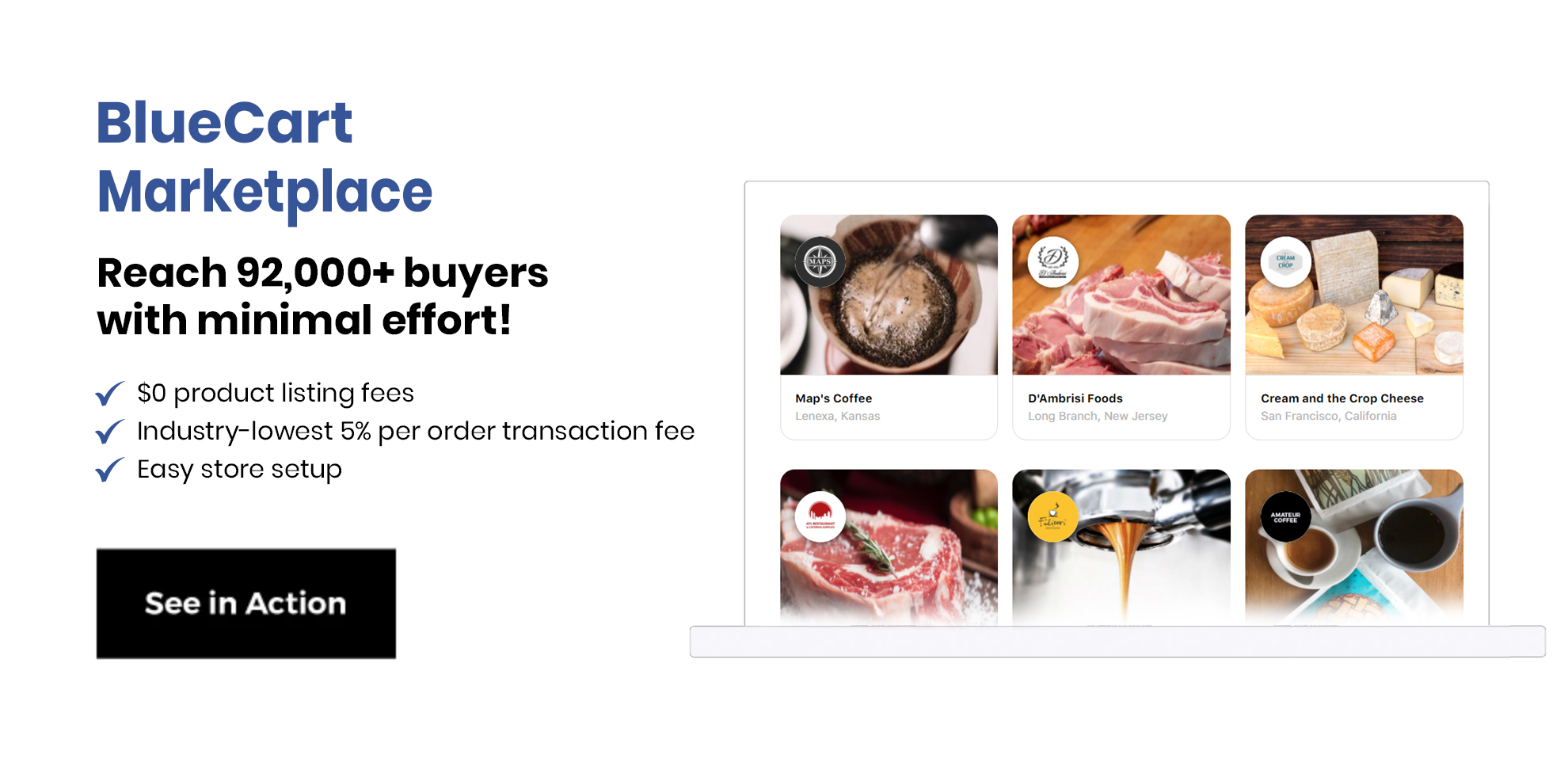

- Low transaction fees. It's unlikely you'll find a merchant account with no fees. Still, you don't want to break the bank every time you make a sale. Calculate your expected sales and pick a merchant with fees low enough that you can still make a good profit. For food suppliers, BlueCart eCommerce is the best choice with robust options to meet their needs.

- Easy to integrate. Your chosen eCommerce website platform is the core of your business. You need to choose a merchant that can easily be integrated and let you get to making sales fast. Otherwise, you'll be sitting around waiting to get your payment processing set up.

- International payment processing. If you're expecting to sell to customers outside the U.S., you need international payment processing. If you don't you'll run into some very upset customers whose orders aren't fulfilled. If you do expect to sell internationally, include this in your eCommerce business plan template. This way you know to shop for the right providers from the start.

- Customer support. As an eCommerce business owner, you can run into issues at any time of day and need help fast. 24/7 Customer support is a lifesaver in these situations and can save you time and money.

The Merchant (Account) of Venice

Finding the right merchant account for your business can help alleviate worry and let you focus on growth. From fraud detection to transaction security, you should evaluate your options and pick the one that best matches your needs.

Now that you know all about the merchant account options available to you, you can continue to turn your great eCommerce business ideas into profitable businesses. Just make sure to get the required eCommerce business license so you don't end up having to pay any fines.

You should also check out an eCommerce blog or pick up an eCommerce book so you can stay on top of current trends and keep your business growing.

Frequently Asked Questions About eCommerce Merchant Account and Services

What is a credit card processing eCommerce merchant account?

A credit card processing eCommerce merchant account is an account that accepts credit card, debit card, and ACH payments through your website. This kind of account allows for secure, fast, and flexible payment options online.

Why do I need a merchant account?

eCommerce businesses need a merchant account in order to accept online payments such as debit and credit cards.

What is an eCommerce merchant?

An eCommerce merchant is a business that sells goods and/or services online.